Fab Bank Balance Check Online: Have you ever heard someone mention that they want to check their fiat bank balance? Are you concerned about checking your Fiat bank account balance in the future but don’t really know how to go about it? If this sounds like something you would be interested in learning more about, read on because we’ve got everything that you will need to know right now. We’ll walk you through the easy process of checking your fiat bank account balance and explain each step clearly so that no matter what type of account you have open, you will learn everything there is to know when it comes to keeping it safe and secure.

One way to do that is by also understanding every possible way to keep your money safe and secure so let’s get started! Additionally, when creating content around banking, if you need any substantial examples of specific banks or brokerage firms, feel free to reach out.

Contents

- FAB Bank Balance Check Process

- Rabi Card Features

- FAB Cashback Offers

- For Expats

- For UAE Nationals

- Fab Bank Online Balance Check

- Fab Bank Salary Account Statement

- What is a Fab account?

- What do I need to open a fab bank account?

- What is a prepaid Nbad Ratibi card?

- How to get FAB Ratibi Card?

- Eligibility criteria for FAB / NBAD prepaid cards?

- Which bank is No 1 in UAE?

- Conclusion

FAB Bank Balance Check Process

It’s easy to keep track of your bank balance on your mobile phone in a few seconds. In fact, it’s called a “regular card balance check”. You’ll find this useful if you happen to combine automatic payments with your Bank Fab MasterCard rather than cash or other credit/debit cards. So you’re able to spend as you like while keeping an eye on your spending very easily. A FAB prepaid card will enable you to do something similar when it comes to keeping track of your current bank balance too. Just follow these simple instructions:

- Go to the official website of the First Abu Dhabi Bank FAB “from here“.

- You will move to The Ratibi Prepaid Card page.

- Click on the Login icon.

- The Login page will appear.

- Click on the Ratibi Prepaid Card Balance Enquiring tab.

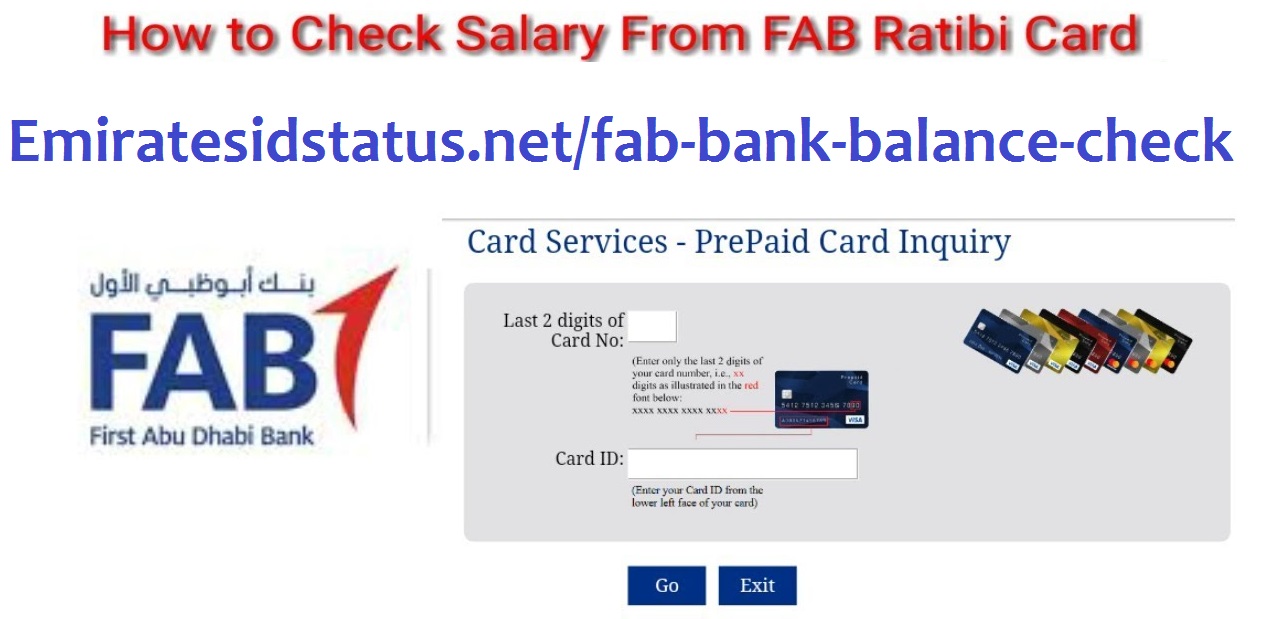

- The Card Services – PrePaid Card Inquiry page will appear.

- Add the last 2 digits of Card No.

- Add Card ID.

- Click on the Go icon.

- The search result will appear immediately.

About Fab Bank

Fab Bank is a completely digital bank that gives users the ability to manage their finances almost 24/7. Fab Bank offers multiple account types, from checking, savings, and money market accounts. You can deposit directly with your phone or simply pick up the nearest check, which takes about 30 seconds. Fab Bank requires no minimum deposit and there are no monthly fees associated with opening an account.

NBAD Bank Prepaid Cards

NBAD Bank prepaid cards allow people to load funds onto the card and then use it almost anywhere that you can use an NBAD credit/debit card. The card comes with a number of benefits and services such as bill payments and money transfers, which means that you don’t need to carry extra cash around but can instead just use your NBAD credit or debit card to handle those everyday services. There are several locations the cards can be used, so it’s best to check out the list on their website or contact NBAD customer service by phone if you have any further questions about their prepaid cards.

Rabi Card Features

On the topic of FAB accounts, there are a couple of different cards to consider. While some UAE residents already have a lot of these cards, others may opt for a ratibi card instead. Unlike most bank accounts, the ratibi salary account was designed to be used as an alternative for low-earning workers. These people’s salaries will be directly deposited onto their cards instead of being delivered to banks

• All UAE residents can apply for Ratibi Card.

• The payment of Ratibi Card salary is done through bank transfer.

• The amount of salary that is credited to your bank account will be equal to any of the following:

– 50% of the annual basic salary.

– 100% of the monthly basic salary.

– 100% of the monthly basic salary, if the salary is more than the basic salary.

• The payment of Ratibi Card salary is done once a month.

• The salary that is credited to your account will be transferred to your bank account through bank transfer.

• The card is only meant for UAE residents.

• The card can be used for shopping, paying bills, and for withdrawing cash from ATM machines.

• The Card can be only used for withdrawing cash up to the amount of your salary credited to the card.

• The card can be used for shopping up to the amount of AED 1,500/- per month.

• The card can be used for payment of bills up to the

FAB Cashback Offers

The Earn Money UAE App rewards people like you with cashback. Here’s how it works: you can earn up to AED 5 thousand if you are a UAE national and up to AED 2500 for those who aren’t nationals of the country but live here. The steps are simple; To get your money, all you need to do is create an account. You will then be able to earn your cash back by shopping at your favorite stores on location, or through the app’s marketplace! Or if you prefer, simply transfer your wages into the account, and watch as it grows.

After funds have been transferred to your Earn Money UAE App account via Salik transactions or direct bank transfers during one or more of the three months preceding last month’s cycle, we will credit this number of amounts into the reward recipient’s account in cash proportional to his contributions. Terms apply. Some conditions may apply.

For Expats

| SALARY PER MONTH | CASHBACK | MINIMUM & MAXIMUM (AED) |

|---|---|---|

| AED 5,000 to AED 25,000 | 2.5% | 125 – 625 |

| AED 25,000 to AED 50,000 | 3% | 750 – 1500 |

| AED 50,000 Plus | 5% | 2500 – 2500 |

For UAE Nationals

| SALARY PER MONTH | CASHBACK | MINIMUM & MAXIMUM (AED) |

|---|---|---|

| AED 5,000 to AED 25,000 | 3% | 150 – 750 |

| AED 25,000 to AED 50,000 | 4% | 1000 – 2000 |

| AED 50,000 Plus | 10% | 5000 – 5000 |

Fab Bank Online Balance Check

If you’re in need of checking your bank balance online, the FAB portal is the best option for you. FAB offers a range of services including online check balances that can be utilized through your mobile device. This makes it easy for you to keep tabs on your finances, no matter where you are. However, students are eligible for multiple discounted rates when making use of these features so FAB should be able to offer even better rates than many other providers after the student rate is applied.

• The FAB portal enables users to check their balances anytime, anywhere.

• No need to visit the bank or ATM.

• Check your account balance, pay bills, and make transfers.

• The FAB portal is available 24/7.

Fab Bank Salary Account Statement

Abu Dhabi Bank’s Balance Inquiry service allows users to easily and quickly view their current bank balance and transactions that have been made in the past. This is a great way for anyone who wants to keep track of their finances and stay informed on their current account status. Simply enter your account number and card id, and you will be brought to a page that displays your current bank balance, recent transactions, and account history. You can also use this service to view your recent transactions by category or by individual account number. Not only that, but you can also use this process to make transfers and payments or check your account’s standing.

What is a Fab account?

A Fab account is an account that allows you to deposit, withdraw and accept payments using your bank card. A Fab account will also enable you to withdraw funds readily!

What do I need to open a fab bank account?

What is a prepaid Nbad Ratibi card?

How to get FAB Ratibi Card?

To qualify for a Ratibi Card, you must meet the requirements of FAB Bank. It is important for both employers and employees to go through this short loan application process.

Eligibility criteria for FAB / NBAD prepaid cards?

An Abu Dhabi Channels customer is eligible for this offer. The customer must hold a FAB account in a name different from that of the cardholder. He/she must be a UAE resident with 100% complete and up-to-date KYC data.

Which bank is No 1 in UAE?

As an entrepreneur, you have to decide whether you want to become more like a tech firm or be more of a traditional business. There are many banks in UAE that are ensuring your money is safe and secure. Now, it’s up to you to choose the one that fits your needs and goals the best. We suggest checking out first Abu Dhabi Bank – they are known for their excellent services and friendly support!

Conclusion

Checking bank balances can be a very helpful tool in terms of managing one’s finances. In order to know exactly how much money you currently have available, you’ll want to make sure that you always have the most accurate information about your current balance. Fab Bank Balance Check Online makes it easy to access this information whenever you need it by providing an easy and convenient way for you to check your bank balance online anytime day or night.

The best part about using their system is that all of your information is 100% confidential because they use state-of-the-art encryption methods and keep their customer data very secure from beginning to end. So if you’re serious about staying on top of your finances while making informed financial decisions, don’t hesitate any longer and check out FAB Bank today!